Vinva Systematic Equities

Dear Investor,

Equity investors have been rewarded with another positive year with many markets and sectors posting double-digit returns over the last 12 months. That said, the journey certainly included more than its fair share of bumps.

Pleasingly, despite the bumps and volatility, both our active Global and Australian equity strategies delivered strong positive outperformance (“alpha”) on top of the equity risk premium across the board.

Many investors spent 24H2 focused closely on the outcome of a US election that was deemed ‘too close to call’ with markets selling off into the event before bouncing back strongly once the uncertainty about the result was lifted. Meanwhile, 25H1 was dominated by trade talks and ‘Trump tariffs’ that triggered significant turmoil for markets including a brutal sell-off and aggressive snap-back.

Throughout this entire period our focus was on ensuring our portfolios were as insulated as possible from any adverse macro reaction regardless of the outcome. We’re happy to report our strict risk controls delivered on this and our portfolios were able to navigate the year exceptionally well.

The last year also saw global markets continue to narrow and it was clear from our conversations with investors that the challenges regarding positioning on the so-called Magnificent 7 were of particular concern. While the Magnificent 7 might have been making the headlines, we preferred to stay neutral in our positions on these stocks and elected to spend our active risk budget in areas where we felt the alpha opportunities were more compelling.

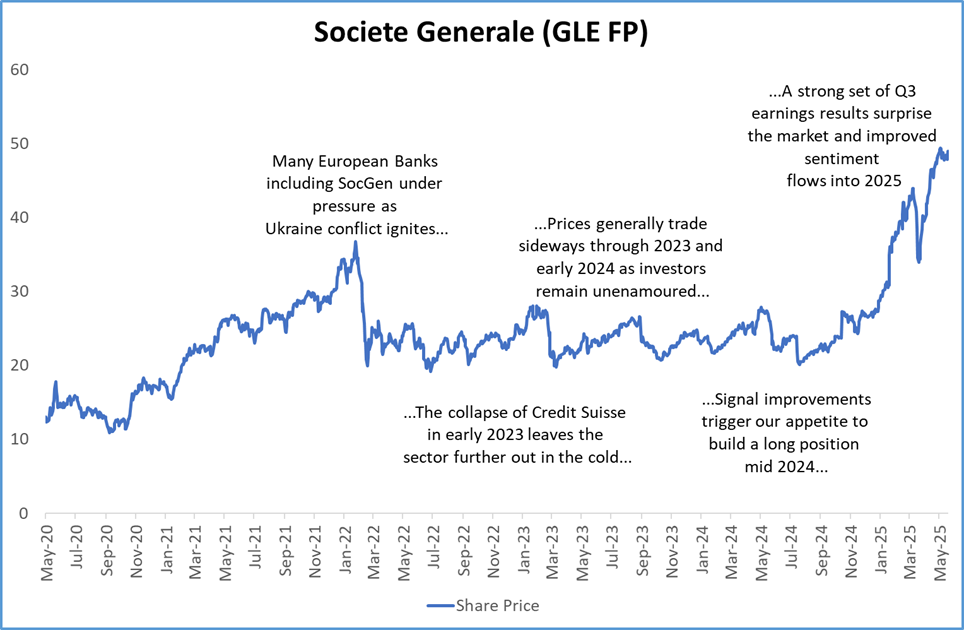

The European banking sector is one area of exploitation in which we have had success over the last year. The sector has been much maligned over recent years and came under significant pressure following the invasion of Ukraine. It had traded sideways for some time but it is often these less glamorous, ‘off-the-radar’ market segments that present opportunity.

A distinct advantage of our active investment approach is that it is designed to cast its ‘alpha opportunity nets’ far and wide and we are continually capturing global information in real time. In July last year, we identified several European banks as potential overweight candidates. While we had (and continue to have) some concerns about the quality attributes of these companies, we balanced these with their deep valuation discounts (especially versus other global banks), a plateauing of the negative sentiment that had plagued the sector earlier in the year, and improving industry dynamics.

As a result, we increased our exposure to Societe Generale, Standard Chartered, Barclays, BNP Paribas and Banco Santander and were rewarded when these stocks enjoyed a strong finish to the calendar year, triggered primarily by a round of positive Q3 results that surprised the market. This sentiment continued into the start of 2025 and the outlook for these companies improved, making this our most profitable region/industry for stock picking over the last year.

European banks surprise the market

Our experienced, and highly focused investment team remains grounded in sensibility with the main objective of delivering outcomes to clients.

We remain overweight this segment although we have reduced the size of our overweight more recently having taken profits in several of the names (including Banco Santander, which we have reduced to below-market weight over the last month).

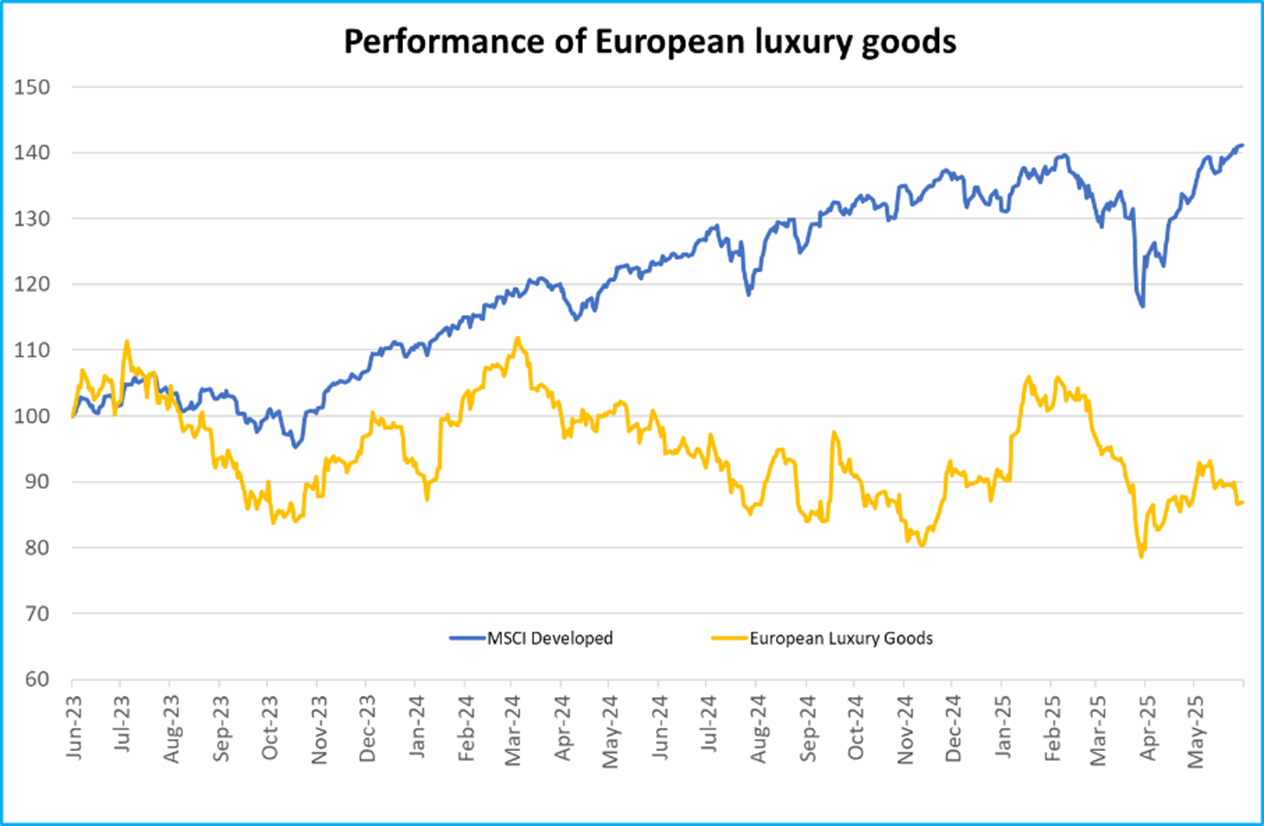

Another less contrarian but equally fruitful opportunity over the last year has been in the luxury consumer segment, which again is well represented in Europe. It is no secret that many of these stocks have struggled over recent years as consumers (and particularly Chinese consumers) have been tightening their (designer) belts. Stocks like LVMH and Kering (whose portfolio of brands includes Gucci, YSL, Balenciaga and o thers) have been profitable underweight/short holdings and perhaps the question facing investors has been more about “Have we reached the bottom yet?”

thers) have been profitable underweight/short holdings and perhaps the question facing investors has been more about “Have we reached the bottom yet?”

An important feature of our active management approach is that we remove emotion from decisions by focusing on the data and the facts. Despite seeing their share price halve from their highs, we continued to systematically assess these stocks as strong candidates for further underperformance. This decision proved a good one as the sector prices continued to tumble through the year. While we did see our negative expectations temper somewhat into the year’s end, it was not enough to prompt us to close our underweight positions and we saw their prospects deteriorate once again in H1 as global trade challenges and tariffs took centre stage. We remain underweight/short.

These are just two examples of successful investments from our portfolios, which include over 500 holdings across Australia and globally. By employing our leading-edge technology and scale of data we are continually finding alpha opportunities, we can harvest our skill while reducing the impact of uncertainty and noise.

As we come to the end of another financial year, we are delighted to have delivered another year of strong outperformance for our clients but are already focusing on the year ahead. We have a mantra at Vinva that you are only as good as tomorrow’s performance and the relentless pursuit of alpha never stops. Our investment approach is based on 30 years of accumulated knowledge and IP. Our experienced, and highly focused, investment team remains grounded in sensibility with the main objective of delivering superior outcomes to our clients.

Vinva Investment Team

Chart 1 Source: MSCI

Chart 2 Source: Vinva Investment Management