Stock Story: Cellnex

In mid-2021, following a debt-fuelled acquisition spree and with markets forecasting a lower-for-longer rate environment, the Cellnex share price hit an all-time high. Roll forward a year and the share price had halved as inflation and interest rates spiked.

It took another two years of the share price languishing before the board replaced the CEO, who came in with a mandate to refocus the business and rectify the balance sheet. We are now largely through that process with sustainable and growing shareholder remuneration backed by a substantial step up in free cash flow generation. We now believe the quality of Cellnex’s business has greatly improved, representing an attractive investment opportunity at a compelling valuation.

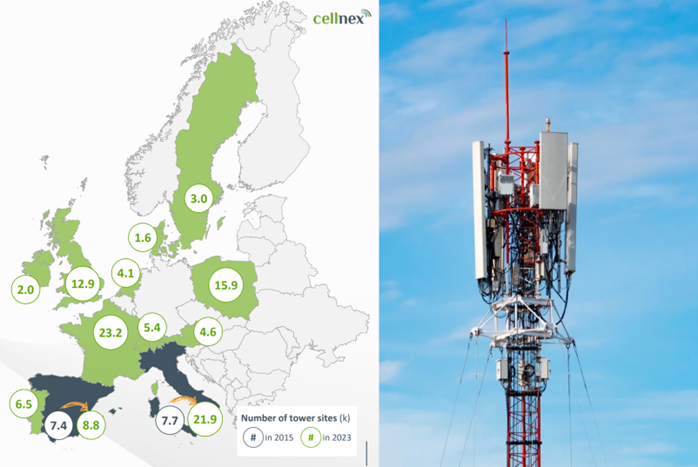

Cellnex is the largest tower company in Europe, owning or managing ~111k towers, largely across five core markets: Spain, Italy, France, the United Kingdom and Poland. Cellnex’s business model involves leasing space on their towers to mobile network operators (“telcos”) to support antenna equipment. Access to power, fibre and the structural integrity of the tower is mission-critical to our community’s everyday mobile connectivity needs. This infrastructure enables someone to watch a YouTube video to help fix a flat tyre, FaceTime an overseas family member or call an ambulance during a medical emergency. Mobile data growth, which is the fundamental driver for these assets, is structural in nature – with Ericsson forecasting mobile data traffic in Western Europe to grow by a 13% CAGR through to 2031.1

Figure 1: Cellnex Telecom asset overview

Cellnex has ~111k towers and ~178k tenants across 10 countries in Europe.

Source: Cellnex company disclosures. Data in image is as at Dec 2023. Note: Cellnex no longer has assets in Austria and Ireland.

1 Ericsson Mobility Report November 2025

Cellnex’s contracts with customers are reflective of quintessential infrastructure

Cellnex’s existing revenues are mostly long-term, contracted and predictable in nature. Existing “anchor” tenants are generally locked into 15- to 20-year leases on a take-or-pay basis with rents escalating annually at CPI or a fixed rate of 1-2%. Cellnex has a lot of bargaining power with customers as it can be complex and capital-intensive to change tower providers without degrading network quality. Furthermore, Cellnex renegotiates anchor leases with customers on an “all-or-nothing” basis, meaning telcos must decide between renewing all antennas or moving every single antenna to another tower. Given Cellnex has a significant proportion of the towers in each of its markets, moving to another tower provider would be exceptionally difficult.

Cellnex can also benefit from other telcos wanting to improve their network coverage or densify their network, as they may lease space on existing towers to new tenants. This is highly profitable for Cellnex as the cost to maintain these simple structures does not increase significantly, thus the majority of new revenue falls to the bottom line.

We believe the market is overestimating consolidation risk

While we believe the positive elements of the investment case are well understood, we think the market has become fixated on the risk of consolidation amongst telcos in Europe, pricing the stock at a substantial discount to our assessment of value because of it, and missing the bigger picture.

There have been many rumours and at least one proposal for consolidation amongst European telcos, particularly in France and Italy. Simplistically, this makes some sense: if four telcos in a market become three, this represents a ~25% drop in available customers, or Cellnex could lose an anchor tenant.

We believe this risk is overstated and that Cellnex can mitigate consolidation impacts for three key reasons:

- Scale & ability to negotiate: Tower contracts generally have change of control clauses; any acquirer will also be acquiring a long-term lease. Cellnex’s scale means they can offer the merged entity flexibility to move equipment and improve their network in exchange for a longer lease term and less revenue lost. There is precedent for this in Spain.

- More rational market structure (and potentially government requirements) should support investment: Europe’s 5G networks are underinvested due to high competition among telcos, which keeps mobile plan prices too low for telcos to make an adequate return on investment. A more rational three-player market should drive long-term demand for Cellnex’s tower assets following consolidation. Moreover, as we saw in the UK with the Vodafone/3 merger, where governments are concerned about Europe’s technological competitiveness, antitrust bodies will likely attach investment commitments (download speeds, number of antennae, etc.) as a condition of any transaction approval.

- Diversification: Even if we were to ignore the contractual protections and likely medium-term investment benefits – if all contracts were somehow cancelled and no future investments were made, the diversified nature of Cellnex’s client portfolio helps to mitigate this risk.

Keep calm and focus on cash flows: We believe the next three years are transformative for Cellnex

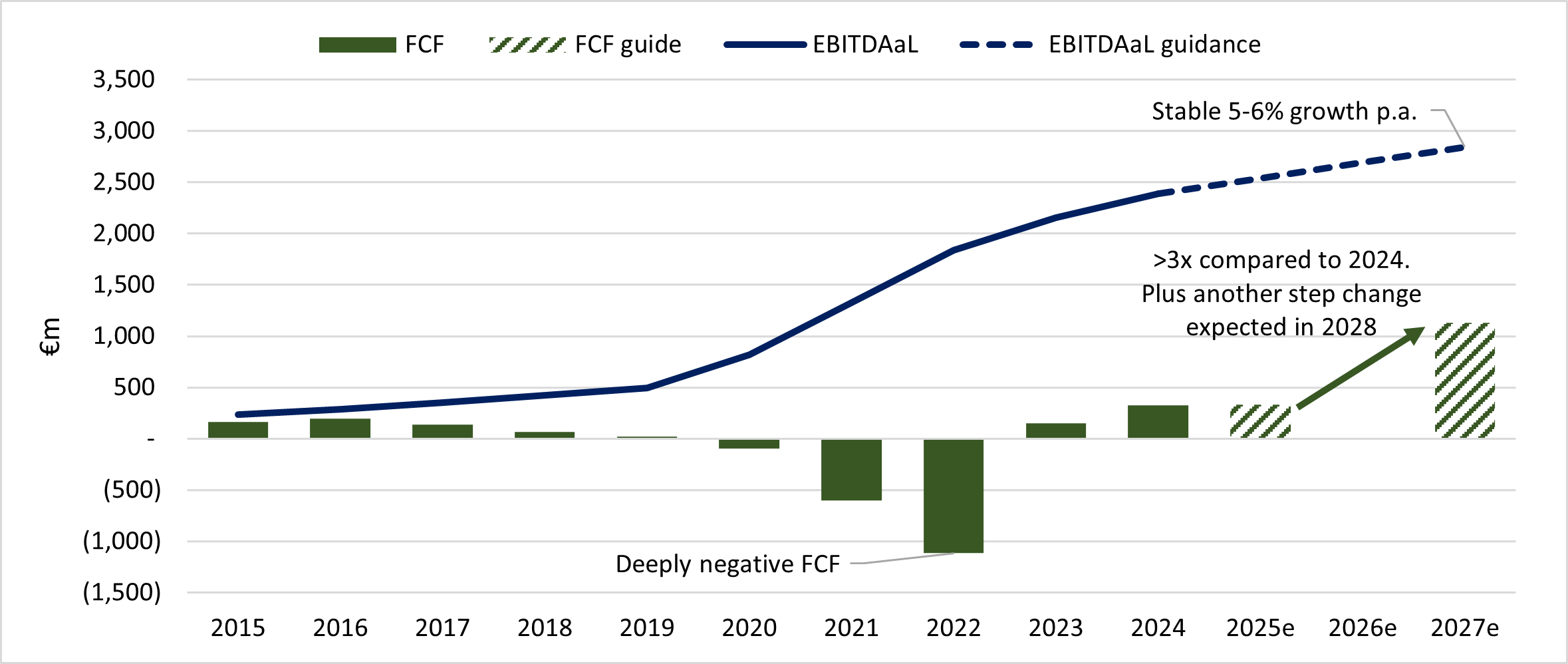

We are long-term oriented investors at Magellan. We look at the merits of an infrastructure investment based on an asset’s ability to generate reliable cash flows. By 2028, Cellnex will have mostly completed its ‘build-to-suit’ capex (an artefact of legacy deal-making that required them to invest large amounts building or acquiring new towers) therefore freeing up substantial amounts of operating cash flows for shareholder remuneration.

Figure 2: Cellnex EBITDAaL (EBITDA after lease expenses) and free cash flow guidance

Source: Cellnex company disclosures

Management expect earnings to grow stably over the next three years due to the strength of its contracts. Free cash flow is expected to be >3x when compared to 2024, supporting shareholder remuneration.

We believe Cellnex has entered a new chapter; one characterised by free cash flow generation, management discipline and shareholder returns. Cellnex has already initiated a dividend policy for 2026 of €500m plus a share buyback plan of €500m. As Cellnex continues to de-lever and complete its inorganic capex obligations, we forecast these returns to grow sustainably over the medium term.

While we would expect some telco mergers to happen (and indeed it makes sense for some of them to occur), the market has appeared to price in a worse-than-worst-case scenario. As the reality plays out, and investors start to appreciate the quality of the business and the attractive and growing shareholder return profile, we would expect long-term investors to be well-rewarded.

By Roy Harrison,

Investment Analyst

Important Information: This material has been delivered to you by Magellan Asset Management Limited ABN 31 120 593 946 AFS Licence No. 304 301 trading as Magellan Investment Partners (‘Magellan Investment Partners’) and has been prepared for general information purposes only and must not be construed as investment advice or as an investment recommendation. This material does not take into account your investment objectives, financial situation or particular needs. This material does not constitute an offer or inducement to engage in an investment activity nor does it form part of any offer documentation, offer or invitation to purchase, sell or subscribe for interests in any type of investment product or service. You should obtain and consider the relevant Product Disclosure Statement (‘PDS’) and Target Market Determination (‘TMD’) and consider obtaining professional investment advice tailored to your specific circumstances before making a decision about whether to acquire, or continue to hold, the relevant financial product. A copy of the relevant PDS and TMD relating to a Magellan Investment Partners financial product may be obtained by calling +61 2 9235 4888 or by visiting www.magellaninvestmentpartners.com

Past performance is not necessarily indicative of future results and no person guarantees the future performance of any financial product or service, the amount or timing of any return from it, that asset allocations will be met, that it will be able to implement its investment strategy or that its investment objectives will be achieved. This material may contain ‘forward-looking statements’. Actual events or results or the actual performance of a Magellan Investment Partners financial product or service may differ materially from those reflected or contemplated in such forward-looking statements.

This material may include data, research and other information from third party sources. No guarantee is made that such information is accurate, complete or timely and no warranty is given regarding results obtained from its use. This information is subject to change at any time and no person has any responsibility to update any of the information provided in this material. Statements contained in this material that are not historical facts are based on current expectations, estimates, projections, opinions and beliefs of Magellan Investment Partners or the third party responsible for making those statements (as relevant). Such statements involve known and unknown risks, uncertainties and other factors, and undue reliance should not be placed thereon. No representation or warranty is made with respect to the accuracy or completeness of any of the information contained in this material. Magellan Investment Partners will not be responsible or liable for any losses arising from your use or reliance upon any part of the information contained in this material.

Any third-party trademarks contained herein are the property of their respective owners and Magellan Investment Partners claims no ownership in, nor any affiliation with, such trademarks. Any third-party trademarks contained herein are the property of their respective owners, are used for information purposes and only to identify the company names or brands of their respective owners, and no affiliation, sponsorship or endorsement should be inferred from such use. This material and the information contained within it may not be reproduced, or disclosed, in whole or in part, without the prior written consent of Magellan Investment Partners. (080825-#W17)